The Quad: Students have a lot to weigh in choice between UC SHIP and private health insurance

By Molly Wright

Sept. 10, 2018 3:09 p.m.

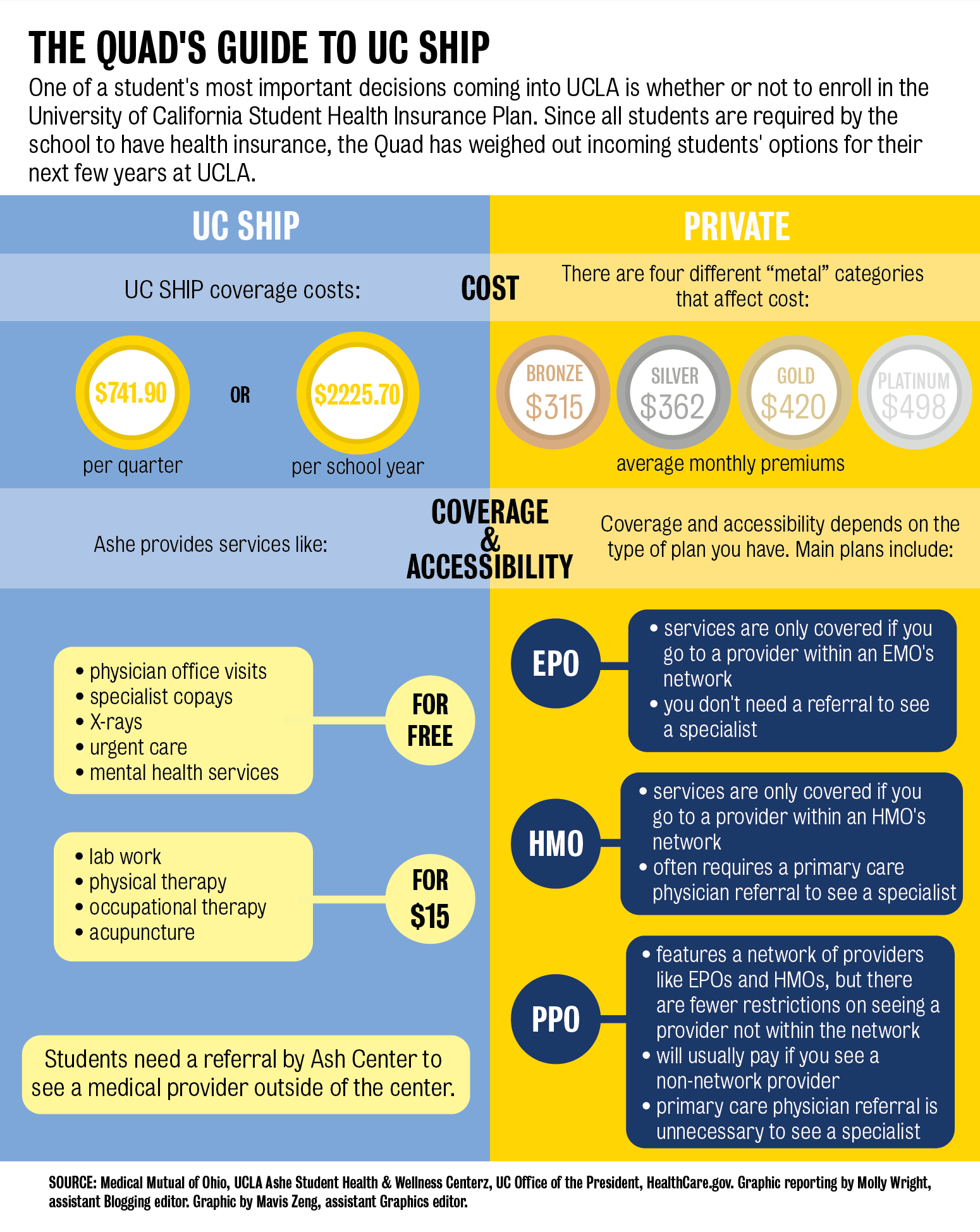

One of the most mind-boggling decisions an incoming freshman or transfer will have to make is whether to use a private insurance plan or adopt the University of California Student Health Insurance Plan, the system’s health insurance package for students.

It’s mandatory to have health insurance at UCLA, so don’t get stuck trying to make a decision after feeling the flu coming on.

Accepting or waiving UC SHIP depends on a variety of factors, such as cost, coverage and accessibility, in contrast to private insurance. However, private insurance isn’t a default for every UCLA student as it is often expensive – 28,000 UCLA students rely on UC SHIP coverage every quarter.

Oftentimes, the amount of private insurance coverage a student receives will affect whether or not they decide to enroll in UC SHIP. Insurance is necessary, but that’s besides the point – you’ll really want it when you start to feel sick winter quarter! The Quad weighed out the factors behind every incoming student’s big health care question: UC SHIP or no UC SHIP?

Cost: UC SHIP coverage costs $741.90 per quarter, totaling $2,225.70 during one school year for undergraduates. The cost of private insurance depends on the type of private insurance plan.

There are four different “metal” categories within private health insurance plans. Health insurance can be bought in the Health Insurance Marketplace, which is a federally operated system that helps people obtain health care. The categories – bronze, silver, gold and platinum – are split based on how high or low the monthly premiums and deductibles are. For example, the bronze plan, the lowest, offers the cheapest monthly premium but the highest cost when you need care. Conversely, the platinum plan offers the highest monthly premium but the lowest costs in the event of illness or injury.

Bronze plans cost, on average, $315 per individual monthly. Silver plans cost about $362, gold plans $420 and platinum plans $498 per month.

An average bronze plan under private insurance would cost about $3,780 for an individual per year. This is more expensive than UC SHIP for one year, potentially affecting whether or not a student decides to take advantage of UC SHIP. Many students may also have to choose UC SHIP if they or their family doesn’t have employer health care and private insurance is too expensive.

Coverage and Accessibility: UC SHIP is most useful at the UCLA Arthur Ashe Student Health & Wellness Center. For students with UC SHIP, services provided by Ashe such as physician office visits, specialist visits, X-rays, urgent care and mental health services don’t cost anything. Similarly, lab work, physical therapy and acupuncture only cost around $15. However, medical providers outside of Ashe don’t always accept UC SHIP, limiting the coverage and accessibility of the program.

According to Ashe’s website, “Medical services must be initiated at The Ashe Center and Ashe referrals are required for all non-emergent services outside of Ashe.” This could be tricky if a student wants to go to a provider outside of school. For example, UC SHIP may not cover health care providers in a student’s hometown, so they cannot receive care under UC SHIP while they’re home during a break. Private insurance generally offers more freedom when choosing where to go for medical help.

However, there are also different levels of health insurance plans that affect coverage and accessibility. Some of the main insurance plans include exclusive provider organizations, health maintenance organizations and preferred provider organizations.

With an EPO plan, doctors and hospitals within the EPO network are covered, but organizations outside the network aren’t. With this plan, you don’t need a referral to see a specialist.

On the other hand, while an HMO is similar to an EPO, it often requires a referral from a primary care physician if a patient wants to see a medical specialist.

Lastly, PPOs feature a network of providers like EPOs and HMOs, but there are less restrictions on seeing a provider outside of the network. PPO insurance will usually cover the cost if you see a non-network provider. With this plan, you don’t need a primary care physician referral.

Cost and accessibility play a major part in deciding whether to adopt UC SHIP or use private insurance. Everyone has a different health insurance situation, so there is no one-size-fits-all determinant. Comparing UC SHIP to your or your family’s health insurance plan is the best way to determine an appropriate course of action for health insurance coverage at UCLA.