US Department of Education extends pause on student loan payments through August

By Saumya Gupta

April 24, 2022 10:07 p.m.

Gwen Chodur would have never been able to afford higher education if it weren’t for student loans. But now, she said, the decisions she makes regarding her career will need to revolve around her ability to pay back her loans.

“I’m grateful that I had the opportunity, but it’s coming at a very high cost, and it’s something that will influence me for the rest of my life,” said Chodur, who is president of the University of California Graduate and Professional Council.

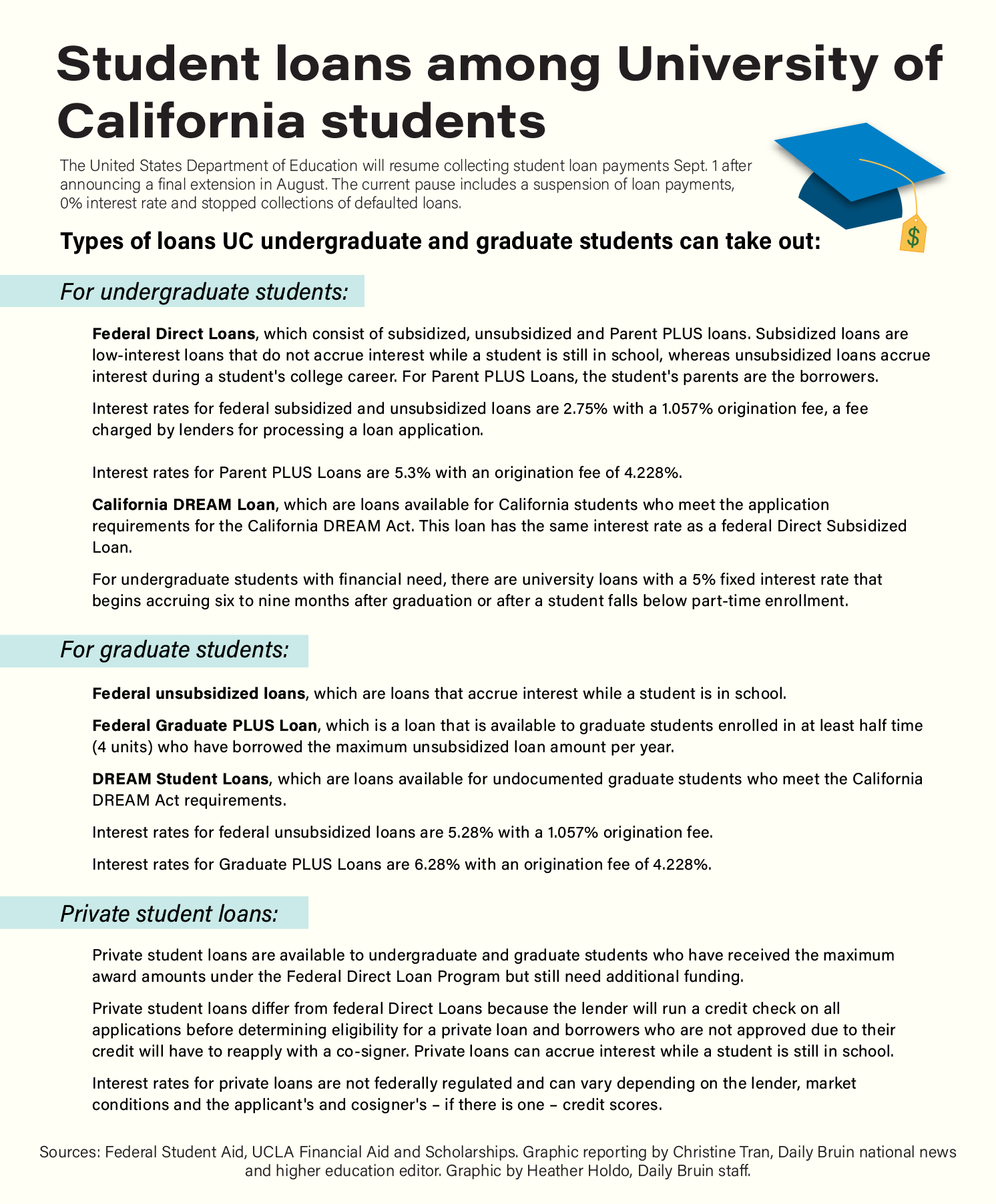

On April 6, the United States Department of Education announced it was extending a pause on student loan payments through Aug. 31. The pause suspends student loan payments, accrues 0% interest on student loans and stops the collection of defaulted loans. The pause initially began in March 2020 to provide relief during the COVID-19 pandemic and has been extended seven times.

At the UC, 44% of students from the class of 2020 graduated with an average of $19,200 in student debt, according to data from the UC’s 2021 Accountability Report. At UCLA, students from the class of 2018 graduated with more than $22,000 in debt on average, according to data from the UCLA Financial Aid and Scholarships 2019-2020 Annual Report.

Chodur, a doctoral candidate in nutritional biology at UC Davis, said the pause has helped students who are still in school because loans stopped accumulating interest.

“I can still put money towards it (my loans) and actually see my capital going down and actually seeing how much I owe going down, even if it’s only $50 a month,” she said. “I’m still able to get ahead of interest.”

During the pandemic, LGBTQ+ individuals have faced more economic insecurity than non-LGBTQ+ individuals, according to the U.S. Census Bureau.

Kerith Conron, the Blachford-Cooper distinguished scholar and research director at the UCLA School of Law Williams Institute, said the relief from the pause helps those dealing with debt and the pandemic’s economic impact on LGBTQ+ individuals. It also helps transgender individuals who are facing issues with getting and sustaining work.

Pausing student loan repayments has been appropriate given the financial challenges the pandemic caused, Chodur added. However, she also said she is worried about the economy and people’s financial situations when the repayments resume.

Moreover, some federal loan servicers, such as Navient, will no longer be servicers because of financial losses, increased oversight and increased scrutiny, according to Forbes. With some servicers now managing larger portfolios, there is concern over whether student loan management will be alright with servicers having more loans to manage, Chodur said. According to Money, loan service transfers can confuse borrowers and be disruptive.

Importance of loans

Ozan Jaquette, an assistant professor at the School of Education and Information Studies, said that although student loans can allow students to find opportunities after getting there that will help them pay back the loan, they can be harmful when students fall further into debt for programs with low graduation rates or job prospects.

When she first took out loans as an undergraduate student, she did not understand the implications, Chodur said.

“It was numbers that didn’t seem quite real because I’d never seen that much money before in my life, and it never was money that actually came to me,” she said. “It just went to the school.”

Joey Lu, a fourth-year international development studies, public affairs and sociology student, said schools can provide higher financial aid packages, more grants, more subsidies or lower the family income threshold to help students avoid loans.

“There’s something wrong with just how expensive higher education is, and something about that needs to be changed,” Lu said.

Loan inequity

Student loan debt also affects certain groups and communities disproportionately.

In July, the Williams Institute found that LGBTQ+ individuals are more likely to have federal student loans in comparison to non-LGBTQ+ individuals.

LGBTQ+ individuals tend to have $16,000 more in loans on average compared to non-LGBTQ+ individuals, according to the Center for LGBTQ Economic Advancement & Research.

Conron said there may be several reasons why LGBTQ+ inidividuals have federal loans: loss of familial support to pay for school, choosing to go to a more expensive school because of its acceptance of LGBTQ+ individuals or remaining in school longer because of its reputation for making LGBTQ+ students feel accepted in higher education spaces.

“My hope is that we can make all educational settings be safe welcoming places for LGBTQ people, so that folks can go to whatever the good, local, low-cost program is and not feel like they've got to go far away and take out high levels of debt in order to go to places that are more welcoming,” she said.

Gary Orfield, a distinguished research professor at the School of Education and Information Studies, said students of color often have long-lasting debt that is hard to manage because of job discrimination. He added that students of color also might not have family resources to go to graduate school and get connected to high-paying jobs, which would help manage their debts.

Black college graduates owe $25,000 more in loans on average nationally compared to white college graduates, according to the Williams Institute.

Chodur added that women and people of color tend to have more student loans and are also the groups that face wage gaps after they finish their degrees.

Two-thirds of student debt is held by female college graduates, according to the Williams Institute.

“It’s a huge equity issue for who gets to go to college and who gets to be financially secure and benefit from that degree once they graduate,” Chodur said.

History of student loans

Orfield said a big problem was the shift to having students and their families pay for higher education from the public. He said state governments should invest more in higher education instead of having students pay more and more with increasing tuition rates.

Since the shift in the beginning of the 1980s, student loans have been a huge problem for young people, Orfield added.

Former President Lyndon Johnson created federal student loans for all students with the Higher Education Act of 1965.

The act had private banks make loans to students and had the federal government pay the bank back for the loan if the student defaulted, Jaquette said. However, banks started to want higher and higher interest rates after the act passed, he said.

During former President Ronald Reagan’s time in office, the student loan system changed, Jaquette said.

The secretary of education believed colleges would raise tuition to match the values students were getting from financial aid, he added. However, Jaquette said the Pell Grant – which did not exceed $2,000 in the early 1980s – was not big enough to affect colleges' tuition dramatically. Pell Grants are a federal aid provided to undergraduates displaying financial need and do not need to be repaid, according to the office of Federal Student Aid.

According to The New York Times, the Reagan administration changed the federal aid program to require families with incomes of more than $30,000 show a financial need to get loans and to reduce the Pell Grant.

The Reagan administration also allowed people to borrow against the equity in their homes, Jaquette said. In turn, the universities responded by increasing their tuition, he said.

Chodur said after the Great Recession from 2007 to 2009, states lessened their investment in higher education. Tuition in turn increased and students had to deal with the consequences, she added.

The pause should be extended, Chodur said. Some people are not in a situation where they can pay back their loans yet, and the system is also confusing with servicers changing, she added.

“At some point, we do need to reckon with the fact that there is this huge student debt problem and (not) just restarting them and acting like everything is going back to normal,” Chodur said. “It's not back to normal. It's not going to be back to normal, and, frankly, it never should have gotten to this point that we have an entire generation that’s just burdened with all this debt.”