The Quad: University endowments explained

(Jessie Hui/Daily Bruin)

By Arthur Wang

Sept. 30, 2017 2:46 p.m.

UCLA’s newfound position as the U.S. News & World Report’s top public university – which it now shares with longtime #1 holder UC Berkeley – will give students something to celebrate.

Administrators, though, are probably thinking about the ensuing financial windfall.

The ability to plaster “NUMBER ONE PUBLIC UNIVERSITY” on campus materials, lampposts, websites and nearly every other public space must make school fundraisers salivate. The ranking’s timing is also impeccable, as UCLA winds down a $4.2 billion capital campaign for its centennial in 2019.

It’s worth asking, then: What is that $4.2 billion dollars, a significant portion of which will go into a $4.34 billion endowment, for? How much of it actually helps students? Why can’t wealthy universities like UCLA tap into their billions and stop charging tuition?

The media prominently features university endowments and their eye-popping figures, but many know little about what they are and what their function is because of their perceived complexity. Yet understanding how endowments work, and why administrators are so keen on increasing their values, can enhance one’s understanding of how higher education in the United States functions in the 21st century.

Not a pile of cash

The greatest misconception anyone can make of a university endowment is that it is a lump sum of cash and precious metals, presumably hidden in the tunnels underneath UCLA’s campus. A portion of an endowment is indeed cash, but most of it is not. An endowment’s dollar amount does measure the worth of its assets, but those assets vary in their liquidity, or how easily they can be turned into cash.

What are those assets? This is where it begins to get complicated; there will be no shortage of financial jargon ahead. Endowments are highly diversified because they are comprised of many different asset classes, or types of investments. Smaller endowments donors give to the university make up much of the main endowment. These funds of funds, so to speak, are called “commingled funds” in the financial reports.

Universities diversify endowment portfolios to minimize exposure to risk, or the odds that a lot of value will be lost to economic downturn or default. A typical endowment contains a wide assortment of stocks and a smaller portion of lower-risk fixed income securities, such as government bonds from the United States and abroad. It usually also contains a variety of more special – ahem – and less common investment options, from venture capital to real estate – and yes, even hedge funds, which the University of California cleverly euphemizes as “absolute return” investments. This diversification is standard in the finance world.

Cashing out: the uses of endowments

The second great misconception of endowments is that universities can spend large portions of them at once, perhaps to drastically reduce tuition or pay workers more, but universities refuse to do so because of greed, malfeasance or incompetence. Understanding endowments’ lack of liquidity unravels this myth.

More importantly, the endowment is not a fund, but an investment on a massive scale, and its managers have a fiduciary duty to generate revenue for the institution. They do so by growing the principal of the endowment – its value in the beginning of the fiscal year, July – as much as possible, in a manner that is consistent and not too risky. That’s what diversification is about, and it’s specifically accomplished by altering the portfolio composition to set percentages so there is never too much money in one type of investment, yet returns are maximized.

Indeed, returns are expected – anywhere between 5 to 15 percent – in years without a recession or a crisis in confidence in any financial sector. When there is a downturn, though, endowments appear to be hurt the most. Moreover, not all investment revenues go to the university. The “payout” rate that goes toward the budget is predetermined by endowment managers each year and is restricted, usually to between 4 and 5 percent. (At UCLA, it was 4.54 percent in 2016.)

To put it in different terms, if a $100 million endowment posts an annual net gain of $10 million and becomes a $110 million endowment, only up to $5 million will be paid out by the managers to fund the university budget. Fund managers then decide to keep the rest of the year’s gains, both to cover inflation and reinvest into the fund, but also to pay themselves.

Growing and maintaining the endowment serves another purpose: securing capital for future investments. The quality and quantity of assets is generally understood to be a proxy for an institution’s financial health. Three agencies rate university creditworthiness, in a way similar to how individual credit scores are reported. A high credit rating ensures that universities can issue bonds (much in the same way school districts and municipalities do to finance projects) at a low interest to bondholders.

The University of California conducts bond issues and sends the money to the individual campuses. Moody’s Investors Service, a bond credit rating company, most recently rated the UC as Aa2 – two notches below the prime grade, because of a slow-burning pension crisis.

Few schools have large ones

The college endowment landscape is remarkably unequal, just as economic disparities abound in the American economy at large. Indeed, the concentration of endowment wealth in the hands of a select few schools is so great that it wouldn’t be a shock if Bernie Sanders begins to mention it in his next stump speech.

Harvard – or media depictions thereof – is definitely to blame here. The media endlessly talks about its $35 billion, leading to the wrong impression of schools’ wealth overall. On the contrary, only 91 out of more than 3,000 four-year colleges have endowments worth more than a billion dollars.

The American Council on Education writes the majority of universities, in fact, have very modest endowments of a few million dollars, or none at all. That means endowment payouts for most schools, particularly less-selective state universities and community colleges, make up only trivial portions of their budgets. On the other hand, Harvard’s 2016 endowment payout of $1.7 billion is a full 36 percent of the university’s budget, and the University of Texas system, which has the largest public school endowment thanks to fossil fuel revenues and land leases, supplies up to 20 percent of annual funding for its flagship campus in Austin, Texas.

Their uses are greatly restricted

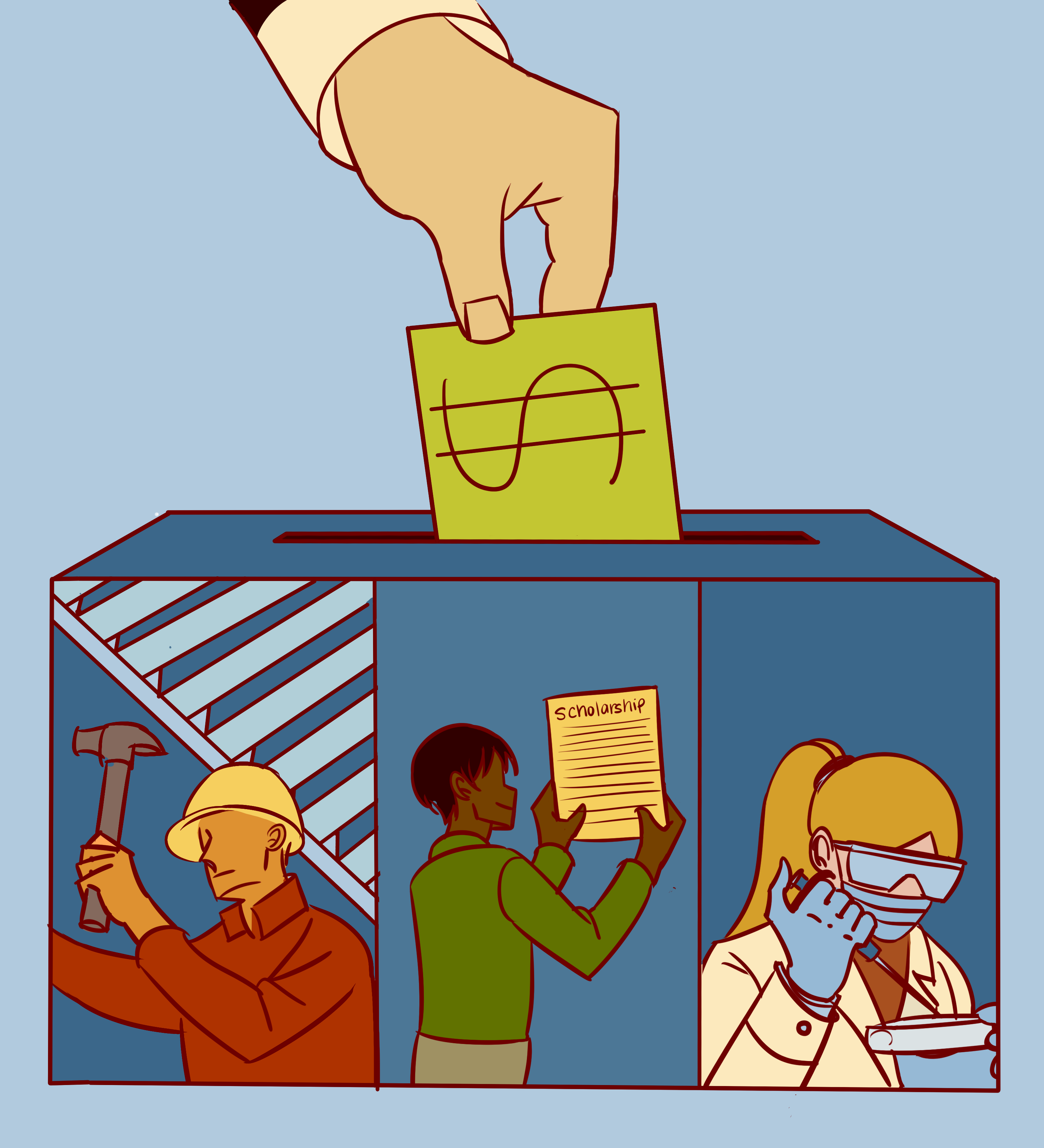

If endowments can’t be used to pay tuition for a decade’s worth of students, what can they be used for? Generally, schools don’t get to decide. Universities are morally and legally obligated to obey the donors’ requests.

Donors most often use contributions to endowments to endow chairs, an elaborate description for giving a faculty member a title and a bonus in pay to support their particular research interests. Usually funded with the revenues generated from the principal donation, chairships are regarded as marks of prestige; endowed chairs are the apex faculty member. Unsurprisingly, they are a dime a dozen at Ivy League schools. At UCLA, there are 302 endowed chairs – and more than 130 additional chairships are unoccupied.

Endowments can also be used to establish scholarships, as David Geffen did four years ago with a $100 million contribution to the medical school. In keeping with the concept that endowment returns, not the principal, are what is given to the university to use, that endowed sum is used to fully fund the medical educations for a handful of students each year.

There is a difference between an endowment and a gift. A designated contribution to an endowment fund means the university can only use the revenues, not the principal, of the donation. A gift is not invested and can be put to immediate use, though the donor can still specify a purpose or recipient. When a school solicits donations, which UCLA seems to do incessantly, it’s usually for university funds, which go straight into next year’s budget and not the endowment.

UCLA’s is not too shabby, though it is a poor performer

At $2 billion as of July, UCLA’s endowment was last reported to be the 47th largest in the country. Its assessed value is $2.4 billion because more than $460 million worth of pledges – promises to donate at a later time or in installments – are included in that number.

UCLA Investment Company, a subsidiary of the UCLA Foundation, manages the money. The only staffing overlap between the two groups is in the chief investment officer, which is the most important and most senior position in fund management. The university’s upper management volunteer as foundation members, while an outside advisory board periodically makes joint decisions on where and what to invest. These boards, like university governing boards, i.e. the UC Board of Regents, are usually comprised of prominent, wealthy and powerful alumni.

Unsurprisingly, the people who manage UCLA’s billions are well paid. These are Wall Street professions, after all, and job occupants can presumably make more in the private sector – or so the thinking goes. Still, the numbers are staggering. The latest available nonprofit tax filings for the UCLA Investment Company show chief investment officer Srinivas Pulavarti earning just north of $1.4 million; total pay for officers and staff is slightly greater than $3 million. To compare, Pulavarti’s counterpart at UC Berkeley earns a little more than half as much. And yet this still pales in comparison to how much the top private school fund managers are paid. A million is a fortune at public schools, but a seeming pittance at privates.

Despite the generous compensation for UCLA fund managers, UCLA’s endowment is among the poorer performers within the UC. One key caveat, though: When only weighed against UC campuses that manage their own endowments, as opposed to six campuses that give some or all of the assets to the UC Office of the President to manage, it is the top performer. None of these four schools – UCLA, UC Berkeley, UC Riverside and UC San Francisco – post endowment return rates that are higher than that of the UC. This suggests they are either paying more for poor performance or are being dealt bad hands from well-meaning donors with lousy funds, a phenomenon that permeates the endowment management sector and is a cause for much ridicule from Wall Street.

UC system makes endowments particularly complex

The structure of the UC makes for an especially complicated division of labor when it comes to endowment management. At most public universities with multiple campuses, there is one flagship campus with disproportionate clout and funding over others, and a central body handles money matters. At the UC, the history and presence of considerable autonomy among the campuses – something UCLA inaugurated when it broke away from being the “southern branch” to become an independent campus – means even endowments are managed in a splintered manner. In UCLA’s case, the foundation works with the aforementioned $2.4 billion, while the UC Regents manages another nearly $2.3 billion. The system has its own endowment; it was worth $10.8 billion as of July, and the UC paid out $321.7 million of it last fiscal year.

Higher education’s future: financialized and privatized

More so than anything else, the existence and growing reliance on endowments and their return on investments is the single most acute indicator of a long-running privatization of public higher education. Once upon a time, only private schools relied on donors and investments to balance the books; public universities, particularly those in California, were generously supported by state budgets.

But myriad factors, including the ever-increasing pressure for universities to provide more for students, the long shadow of Ronald Reagan, one of the earliest and most prominent advocates of reducing state support for public schools and the lack of a state funding guarantee – the Master Plan, a state framework for California’s public universities, guides but does not constitute law – has led to a precipitous decline in public fiscal support for the UC system.

Indeed, the statistic that the state only funds 7 percent of the UC is repeated everywhere on university philanthropy sites. It’s supposed to encourage donors to step up to the plate and fund the university because the state doesn’t want to. That’s a convenient, if not dangerous, reframing of the reality that the state is veering toward a total abdication of its role in supporting state schools. Ultimately, whether there is funding or no funding, or if the school is private or public, universities across the country have committed to grow their endowments to serve as budgetary insurance policy, to engage with alumni and to show off and climb the rankings.