Changes in retirement plan under state, UC budget garner criticism

By Shreya Maskara

Sept. 24, 2015 9:04 a.m.

The budget deal signed between University of California President Janet Napolitano and Gov. Jerry Brown in May signifies a change in the retirement plan offered to new employees that faculty members and experts believe will affect the future of the UC system.

Earlier this year, Napolitano appointed a systemwide task force of UC faculty, staff and administrators intended to draft a new set of retirement benefits that will include a lower pension tier and could give future employees the option of shifting from a defined benefits plan to a defined contribution plan.

A defined contribution plan is a retirement plan in which the employer, employee or both, make contributions on a regular basis. In a defined benefit pension plan, an employer or sponsor promises a specified monthly amount based on the employee’s earning history, service and age.

The state promised $436 million in May intended to help reduce the UC’s long-term pension debt of $7.8 billion over a three-year period.

Celeste Langan, a co-chair of the UC Berkeley Faculty Association, said she thinks the state and the UC do not have a good history of keeping their promises. She added she thinks there is no guarantee the UC will receive the rest of the money, because the agreement signed between the two only specifies the one-time $96 million contribution.

Shane White, a professor at the UCLA School of Dentistry and member of the task force, said he thinks the task force shares the same concern.

White added he thinks it’s important to consider the fact that the legislature has treated the California State University system more generously when it comes to pension obligations than the UC.

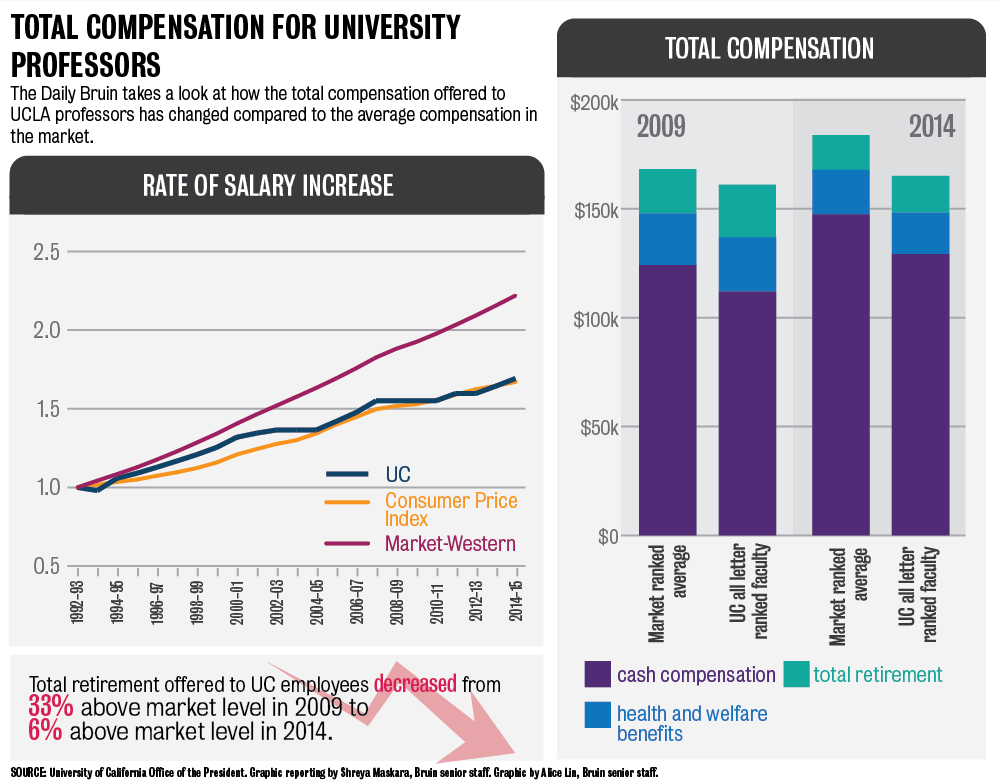

According to a report presented to the Committee on Compensation at the UC Regents meeting in July, the total remuneration offered to a UC employee is 10 percent less than what is offered to faculty at other universities. In addition, UC benefits do not compensate for lower-than-market salaries in the calculation of total faculty remuneration.

Dan Mitchell, a professor emeritus at the UCLA Anderson School of Management and a board member of the Faculty Association at UCLA, said he thinks the University will have to come up with some form of additional benefits in its recruitment package to attract new faculty.

“The state needs to realize that the regents don’t have a printing machine for money,” Mitchell said.”The legislature is making sure to say it’s not its responsibility, which means they are essentially saying this should come out of research funding, teaching resources or student tuition.”

In this year’s budget, the UC lowered the cap on new employees’ salaries used to calculate guaranteed pension from $265,000 to about $117,000. The University agreed to a lower cap in exchange for a one-time payment of $96 million from the state.

A 20-year contribution freeze from the University and the state resulted in the UC Retirement Plan’s $7.8 billion unfunded liability.

Dan Pellissier, president of California Pension Reform, a political organization dedicated to solving California’s pension crisis, said he thinks the pension holiday created by the University was one of the great public policy failures of the generation.

Pellissier added he thinks faculty, students and administration know the current plan will not work, and steps need to be taken to address the issue.

“The UC is acting like someone who talks a lot about losing weight but doesn’t do anything about it,” Pellissier said. “There comes a point where you need to start exercising and dieting to lose that weight, instead of just talking about it.”

H.D. Palmer, deputy director for external affairs at the California Department of Finance, said according to the funding plan the overall state contribution toward the unfunded liability of the UCRP will be $436 million over the next few years.

UC spokesperson Shelly Meron said she thinks faculty members are pleased with the option to have a defined contribution plan that aims to allow younger faculty members to be portable, if they decide to take a job at another institution.

Langan said she thinks the changes show the University is being run like a corporation.

“I think the UC is being disgusting,” Langan said. “Faculty should not be encouraged to be mobile but instead to stay at the University for a longer time so academic programs can be strengthened.”

White added he is concerned the new pension tiers will create a divide between the workers and faculty. He added a united faculty has been one of the strengths of the University.

Mitchell also said he thinks the pension debate signifies a further declining relationship between the UC and the state because the state is investing less money in the UC.

“If you build a bridge and don’t (maintain it), in a couple years there will be several cracks and eventually the bridge will collapse,” Mitchell said. “I’m afraid the same thing might happen to the UC education system if we don’t address these issues properly.”

The task force is expected to deliver its recommendations to President Napolitano by early 2016.